Thent: Real-World Asset Tokenization for Collectibles

Comprehensive Technical Whitepaper & Analysis: A detailed 136-page exploration of transforming physical treasures into liquid digital assets through blockchain innovation, community governance, and professional custody infrastructure.

Explore all technical details, architecture, and implementation specifications in the sections below.

Market Opportunity & Growth Trends

The collectibles market represents a massive, underserved opportunity for blockchain tokenization with explosive growth in RWA adoption

Global Collectibles Market

Current valuation

Total addressable market for physical collectibles including art, antiques, and memorabilia

Projected 2028 Value

Market projection

Expected market size by 2028 driven by increasing collector demand and investment interest

RWA Tokenization Market

June 2025 on-chain

Rapid growth from $5B in 2022 to $24B+ on-chain, making RWA tokenization fastest-growing crypto sector

Monthly Trading Volume

Courtyard.io March 2025

Example of explosive growth in tokenized collectibles trading, from $10.5M to $56.4M in months

Illiquidity Crisis

Physical collectible sales take weeks or months vs. seconds on-chain

Traditional Process:

Weeks/months for sale completion

Thent Solution:

Instant on-chain trading 24/7

Market Impact:

Increases trading velocity by 100-1000x

High Barriers to Entry

Expensive items accessible only to wealthy individuals or institutions

Traditional Process:

Need full asset value upfront

Thent Solution:

Fractional ownership from $100

Market Impact:

Opens market to millions of new participants

Geographic Fragmentation

Local/regional markets with limited global reach and price discovery

Traditional Process:

Limited to local/regional buyers

Thent Solution:

Global 24/7 digital marketplace

Market Impact:

Price discovery across worldwide demand

Authenticity & Provenance

Fraud and forgery plague high-end collectibles market with opaque verification

Traditional Process:

Reliance on paper certificates

Thent Solution:

Blockchain-based provenance tracking

Market Impact:

Reduces fraud and increases buyer confidence

Transactional Friction

Traditional sales involve 20%+ in fees, escrow, insurance, and middlemen

Traditional Process:

Multiple intermediaries and fees

Thent Solution:

Smart contract automation

Market Impact:

90% reduction in transaction costs

Competitive Landscape Analysis

Learning from early movers while building a superior, decentralized protocol that addresses current market limitations

Americana

Focus: High-end collectibles

Funding: VC-backed by Alexis Ohanian & OpenSea

Business Model:

Concierge vaulting with digital certificates

Key Achievement:

9,500 membership NFTs sold in 2022

Strengths

- • Professional vaulting

- • Strong partnerships

- • Premium brand

Limitations

- • Limited to high-end items

- • Centralized approach

- • No fractionalization

Thent Differentiator

Thent offers broader accessibility and decentralized governance

Courtyard

Focus: Physical trading cards

Funding: $7M led by Brink's

Business Model:

Brink's vault storage with 3D NFT representations

Key Achievement:

$56.4M monthly volume (March 2025)

Strengths

- • Trusted security partner

- • Proven volume growth

- • Pack opening features

Limitations

- • Single asset category

- • Centralized control

- • Limited tokenomics

Thent Differentiator

Thent provides multi-category support and comprehensive tokenomics

Dibbs

Focus: Sports cards fractionalization

Funding: Amazon-backed

Business Model:

Fractional NFT ownership of single items

Key Achievement:

Early fractional collectibles pioneer

Strengths

- • Fractional innovation

- • Strong backing

- • User-friendly interface

Limitations

- • Regulatory scrutiny

- • Limited asset types

- • Compliance challenges

Thent Differentiator

Thent addresses regulatory concerns with proper legal framework

StockX Vault NFTs

Focus: Sneakers and streetwear

Funding: Public company resources

Business Model:

ERC-1155 tokens for vault-stored items

Key Achievement:

Mainstream brand recognition

Strengths

- • Established marketplace

- • Brand recognition

- • User base

Limitations

- • Legal disputes with brands

- • Limited crypto integration

- • Centralized platform

Thent Differentiator

Thent provides decentralized, brand-agnostic protocol

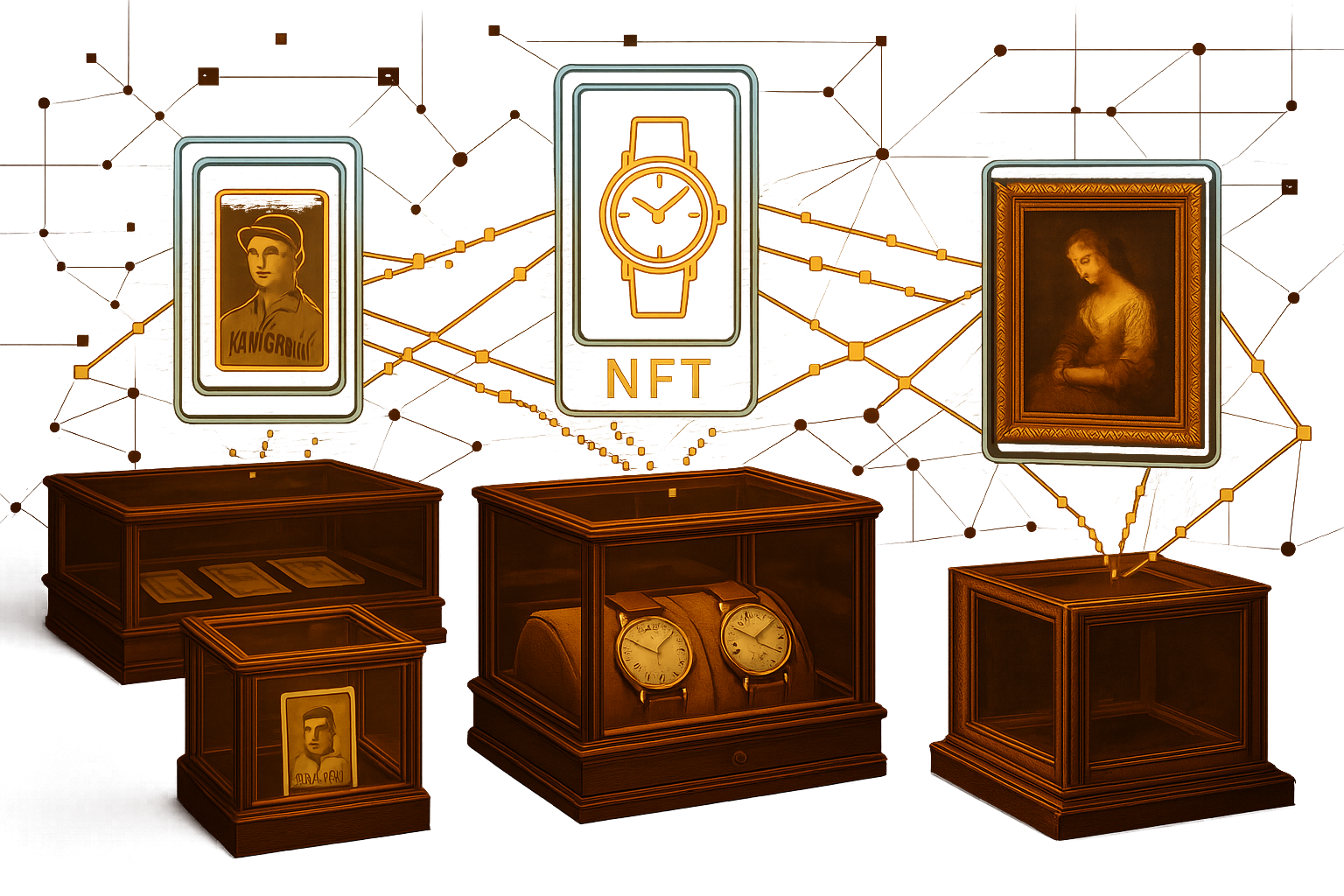

Vision & Narrative: Bridging Physical and Digital Realms

"Turn tangible treasures into trustable tokens" - Thent's mission emphasizes both the cultural significance of collectibles and the trust provided by blockchain technology.

The Bold Vision

Protocol Innovation

Bridging physical and digital worlds

Thent is a Web3 protocol with a revolutionary vision: bring real-world collectibles on-chain to unlock liquidity, community governance, and global access to tangible assets. In today's world, investing in rare art, antiques, and cultural artifacts is often limited to elite circles or involves slow, opaque processes.

Democratizing Ownership

Imagine a rare painting or vintage watch that typically sits idle in a vault - with Thent, that object can be minted as an NFT, representing verifiable digital title to the physical item. This NFT can then be traded or staked in decentralized finance, allowing the collectible to participate in a fluid digital market.

Cultural Heritage Meets Innovation

Every tokenized item tells a story, anchored in cultural heritage yet empowered by blockchain innovation. Thent positions itself at the intersection of an art gallery and a fintech platform - where a Renaissance painting or rare baseball card can be handled with the same fluidity and transparency as a digital asset.

Community-Driven Collections

Thent's vision creates a world where collections are community-driven: enthusiasts can pool funds to own stakes in valuable items, curators and experts guide which assets get tokenized, and every token holder becomes a custodian of culture.

Key Value Propositions

Global Accessibility

24/7 trading vs. limited auction hours

Fractional Ownership

$100 minimum vs. $1M+ traditional barriers

Instant Liquidity

Seconds vs. weeks/months for traditional sales

Reduced Costs

1-2% fees vs. 20%+ traditional costs

Target Outcomes

Protocol Architecture: Modular & Chain-Agnostic

Thent's architecture is designed as a modular asset protocol to flexibly support the lifecycle of tokenized collectibles with security, composability, and interoperability across multiple blockchains.

Technical Stack & Implementation

Frontend Layer

Modern web3 interface with responsive design and seamless user experience

Technologies:

API Gateway

Scalable backend services handling user requests and blockchain interactions

Technologies:

Blockchain Layer

Smart contracts for NFT minting, fractionalization, and governance

Technologies:

Infrastructure

Decentralized storage and secure infrastructure for assets and metadata

Technologies:

Asset Registry (NFT Module)

Issues unique NFTs for each physical collectible with comprehensive metadata and custody certificates using ERC-721/1155 standards

Key Features:

Technical Specifications:

Custody & Oracle Layer

Professional vault integration with custodial oracles bridging on-chain and off-chain status using trusted hardware and multi-signature verification

Key Features:

Technical Specifications:

Minting & Burning Controls

Multi-step intake process ensuring one-to-one correspondence between NFTs and physical assets with stake-based security

Key Features:

Technical Specifications:

Packaging & Fractionalization

Convert NFTs into fungible tokens for fractional ownership or bundled exposure with governance mechanisms and DeFi integration

Key Features:

Technical Specifications:

Chain-Agnostic Deployment Strategy

Multi-Chain Support

Deploy on Ethereum, Polygon, Arbitrum, and other EVM-compatible chains

Cross-Chain Bridges

Secure asset and token movement across different blockchain networks

Unified Security

Consistent security standards and audit coverage across all deployments

Smart Contract Architecture

Core Contract Suite

ThentNFT.sol

ERC-721 compliant contract for minting and managing collectible NFTs with metadata and provenance tracking

Fractionalization.sol

Converts NFTs into ERC-20 tokens for fractional ownership with governance and buyout mechanisms

CustodyOracle.sol

Oracle system for verifying physical asset custody and insurance status with multiple data sources

Governance.sol

DAO governance contract handling proposals, voting, and execution with timelock mechanisms

Security Features

Multi-sig Requirements

Critical operations require multiple authorized signatures

Time-lock Delays

Administrative changes have mandatory waiting periods

Pausable Contracts

Emergency stop functionality for security incidents

Upgradeable Proxies

Secure contract upgrades without losing state

Access Controls

Role-based permissions for different user types

Reentrancy Guards

Protection against reentrancy attacks

Protocol Layer Architecture

Security & Standards Framework

Smart Contract Security

Compliance Integration

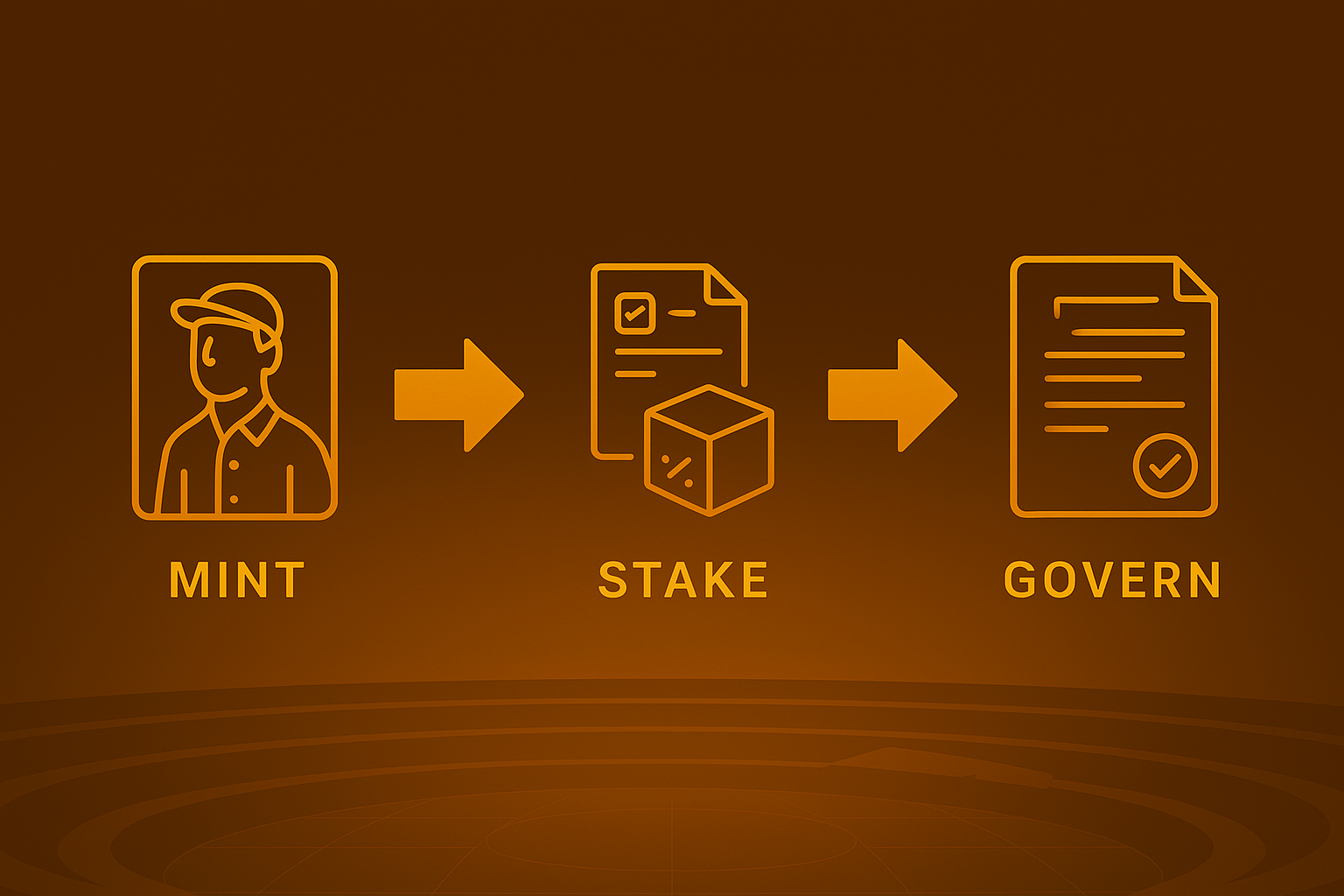

Four-Phase Asset Lifecycle Model

Thent's innovative approach guides collectibles through their complete digital transformation: Mint, Stake, Package, and Govern.

Mint

Tokenize the Collectible

Transform physical collectibles into secure digital assets through verification and custody

Key Steps:

Stake

Utilize and Earn

Stake NFTs or $THENT tokens to earn rewards and participate in ecosystem governance

Key Steps:

Package

Fractionalize or Bundle

Create fungible token representations for increased accessibility and liquidity

Key Steps:

Govern

Community Oversight

DAO governance ensuring fair, evolving, and community-aligned system operations

Key Steps:

Complete Asset Lifecycle Workflow

Phase 1: Mint - Asset Tokenization Process

Prerequisites & Submission

- • Asset ownership verification documents

- • Initial $THENT stake (refundable security deposit)

- • Detailed item description and provenance

- • High-resolution photography from multiple angles

Verification & Custody

- • Expert authentication by certified appraisers

- • Professional photography and condition assessment

- • Secure vault storage with tamper-evident tracking

- • Insurance policy activation and coverage confirmation

Output: ERC-721 NFT minted with comprehensive metadata, custody certificate, and marketplace readiness.

Phase 2: Stake - Asset Utilization & Rewards

NFT Staking Benefits

- • Earn 5-12% APY in $THENT tokens

- • Increased governance weight for voting

- • Early access to new asset drops and features

- • Participation in curation committee decisions

$THENT Token Staking

- • Revenue sharing from platform transaction fees

- • Boosted voting power (up to 2x multiplier)

- • Access to premium platform features

- • Insurance fund participation rewards

Output: Passive income generation while maintaining asset ownership and contributing to platform security.

Phase 3: Package - Fractionalization & Bundling

Fractionalization Options

- • Create ERC-20 tokens representing asset shares

- • Set custom fraction supply and initial pricing

- • Establish governance rules for fraction holders

- • Enable DEX trading for immediate liquidity

Asset Bundling Strategies

- • Create thematic investment funds (e.g., "Art Deco Collection")

- • Portfolio diversification across asset categories

- • Professional curation and management services

- • Index-style exposure to collectibles market

Output: Increased market accessibility, enhanced liquidity, and democratized ownership of high-value assets.

Phase 4: Govern - Community Decision Making

Protocol Governance

- • Vote on fee structures and platform parameters

- • Approve new custodian partnerships

- • Decide on asset category expansions

- • Manage community treasury allocation

Asset-Level Decisions

- • Fractional asset management and buyout votes

- • Dispute resolution for authenticity challenges

- • Insurance claim processing and settlements

- • Emergency protocol responses and upgrades

Output: Transparent, community-driven platform evolution ensuring long-term sustainability and user alignment.

Single-Token Economy: $THENT

$THENT 作为统一代币驱动所有经济和治理功能,整合平台所有利益相关方。

Governance Power

Each $THENT token grants voting rights on protocol proposals and platform direction

Vote on fees, partnerships, upgrades

Staking Rewards

Stake $THENT to earn a share of protocol fees and additional ecosystem benefits

Fee sharing, boosted governance weight

Platform Fees

Pay protocol fees in $THENT for discounts and enhanced platform access

Reduced fees, premium features

Collateral & Access

Required for advanced features like becoming a verifier or high-value operations

Verifier bonds, premium access

Token Distribution Model

Value Capture Mechanisms

Token Generation Event (TGE) & Vesting Schedule

Comprehensive vesting schedule designed following industry best practices with proper cliff periods, linear vesting, and market cap considerations.

| Allocation Category | Percentage | Token Amount | TGE Release | Vesting Period |

|---|---|---|---|---|

| Ecosystem Development | 35% | 73.5B THENT | 30% | 48 months linear |

| Team & Advisors | 20% | 42B THENT | 0% | 12 months cliff + 36 months linear |

| Strategic Partnerships | 15% | 31.5B THENT | 25% | 6 months cliff + 24 months linear |

| Community Rewards | 12% | 25.2B THENT | 30% | No vesting |

| Public Sale | 8% | 16.8B THENT | 25% | No vesting |

| Treasury Reserve | 10% | 21B THENT | 15% | Governance controlled |

| Total Supply | 100% | 210B THENT | - | - |

Ecosystem Participants & User Roles

The Thent ecosystem involves diverse participants, each with distinct motivations and responsibilities, creating a comprehensive network for collectible tokenization.

Collectible Owners

Individuals who own real-world collectibles and wish to tokenize them

Key Responsibilities:

Buyers/Investors

Crypto-native users who buy NFTs or fractional tokens as investments

Key Responsibilities:

Custodians

Secure storage providers who physically hold the collectibles

Key Responsibilities:

Verifiers/Appraisers

Experts who validate authenticity and condition of collectibles

Key Responsibilities:

Curators/Packagers

Specialists who create bundles or fractional offerings

Key Responsibilities:

Governance Participants

Any $THENT holder participating in protocol governance

Key Responsibilities:

Ecosystem Incentive Alignment

Role-Based Incentive Structure

- • Revenue from asset sales and fractionalization

- • Staking rewards while holding tokenized assets

- • Governance participation in asset curation

- • Insurance coverage and professional custody

- • Storage fees paid in $THENT or stablecoins

- • Performance bonuses for high-quality service

- • Long-term contracts with guaranteed volume

- • Reputation system driving customer preference

- • Per-item verification fees based on asset value

- • Reputation scoring affecting future assignments

- • Staking requirements with slashing for fraud

- • Bonus rewards for accurate high-value assessments

Community Coordination Mechanisms

Reputation Systems

On-chain reputation tracking for all service providers with NFT badges for achievements

Dispute Resolution

Multi-tier arbitration system with expert panels for authenticity disputes and community jury for general issues

Cross-Role Collaboration

Incentive structures that reward cooperation between roles, such as verification-custody partnerships and curator-investor alignment

Knowledge Sharing

Community-driven educational resources with token rewards for contributing expertise and helping newcomers

Development Roadmap & Milestones

Structured development timeline balancing technical milestones, community growth, and regulatory compliance from foundation to mainstream adoption.

Q2 2025

Foundation & Prototype

Q3 2025

Token Generation Event

Q4 2025

Testnet Beta & Security

Q1 2026

Mainnet Launch

Q2-Q3 2026

Expansion & Features

Q4 2026

Community Growth

2027+

Mainstream Adoption

Legal Framework & Risk Analysis

Transparent disclosure of regulatory challenges, operational risks, and comprehensive mitigation strategies for responsible tokenization.

Important: Tokenizing real-world assets involves complex legal and regulatory considerations. Thent is committed to transparency and proactive risk management.

Regulatory Uncertainty

Risk: Securities regulations may apply to fractional tokens

Mitigation: Legal counsel engagement, compliance framework, regulatory sandboxes

Custodial Risk

Risk: Physical asset theft, damage, or custodian failure

Mitigation: Multi-custodian model, comprehensive insurance, regular audits

Smart Contract Risk

Risk: Potential bugs or vulnerabilities despite audits

Mitigation: Multiple audits, bug bounties, gradual rollout, emergency procedures

Market Volatility

Risk: Token values may fluctuate significantly

Mitigation: Diversified asset categories, market maker programs, reserve funds

Authenticity Risk

Risk: Counterfeit items entering the protocol

Mitigation: Expert verification committee, authentication technology, insurance coverage

Compliance & Legal Framework

Regulatory Compliance

Working with legal counsel in major jurisdictions for securities compliance and regulatory clarity

Legal Structure

Establishing proper legal entities and frameworks to support tokenized asset ownership

Transparency

Full disclosure of risks, regular reporting, and community-driven governance decisions

Comprehensive Legal & Regulatory Strategy

Multi-Jurisdictional Approach

United States

- • SEC no-action letter for fractional tokens

- • CFTC guidance on commodity classification

- • State-level money transmitter licenses where required

- • Anti-money laundering compliance framework

European Union

- • MiCA compliance for crypto-asset services

- • GDPR data protection implementation

- • Member state securities regulations

- • VAT treatment clarification

Singapore & Asia-Pacific

- • MAS digital payment token framework

- • Hong Kong virtual asset licensing

- • Japan virtual currency exchange registration

- • Cross-border regulatory coordination

Risk Mitigation Strategies

Securities Regulation

Risk: Fractional tokens classified as securities

Mitigation: Accredited investor restrictions, utility token design, regulatory sandbox participation

Cross-Border Enforcement

Risk: Conflicting regulatory requirements across jurisdictions

Mitigation: Modular compliance system, geo-blocking capabilities, legal entity structure

Cultural Heritage Claims

Risk: Artifacts subject to repatriation claims

Mitigation: UNESCO compliance screening, provenance verification, voluntary cooperation protocols

Tax Compliance

Challenge: Complex tax implications across multiple jurisdictions

Solution: Tax reporting tools, professional advisory partnerships, user education resources

Legal Innovation Framework

Proactive Engagement

Regular dialogue with regulators and participation in industry working groups

Adaptive Compliance

Modular legal framework that can adapt to changing regulatory requirements

Industry Leadership

Contributing to development of RWA tokenization standards and best practices

Complete Table of Contents

Explore our comprehensive 136-page analysis covering every aspect of the Thent Protocol ecosystem

Vision and Narrative

Thent's bold vision to democratize ownership of high-value collectibles through blockchain tokenization, bridging physical and digital realms with the mission to 'turn tangible treasures into trustable tokens'.

Key Highlights:

Market Analysis

Comprehensive analysis of the $372B collectibles market, growth trends, pain points, and competitive landscape in RWA tokenization, including detailed case studies of Americana, Courtyard, and StockX.

Key Highlights:

Protocol Architecture

Modular, chain-agnostic architecture with NFT registry, custody oracles, minting controls, and fractionalization modules. Designed for security, composability, and interoperability.

Key Highlights:

Asset Minting & Packaging

Four-phase model: Mint, Stake, Package, and Govern - guiding collectibles through their complete digital lifecycle with detailed verification and custody processes.

Key Highlights:

Tokenomics

Single-token economy with $THENT driving governance, staking rewards, fees, and ecosystem incentives. 210B total supply with community-focused distribution.

Key Highlights:

Governance & DAO

Decentralized governance structure with specialized committees, voting mechanisms, and progressive decentralization path towards full community control.

Key Highlights:

User Roles

Comprehensive ecosystem of collectors, investors, custodians, verifiers, curators, and governance participants with clearly defined responsibilities and incentives.

Key Highlights:

Roadmap & Milestones

Structured development roadmap from Q3 2025 foundation through 2028+ mainstream adoption, with specific milestones and success metrics.

Key Highlights:

Legal & Risk Disclosures

Transparent disclosure of regulatory challenges, custodial risks, legal considerations, and comprehensive risk mitigation strategies for responsible tokenization.

Key Highlights:

Complete Technical Documentation

This whitepaper provides comprehensive technical specifications, implementation details, and architectural decisions for the Thent Protocol ecosystem.

Implementation Status: All technical specifications are actively being developed with progressive rollout planned post-TGE. Visit our roadmap section above for detailed timelines and milestone tracking.